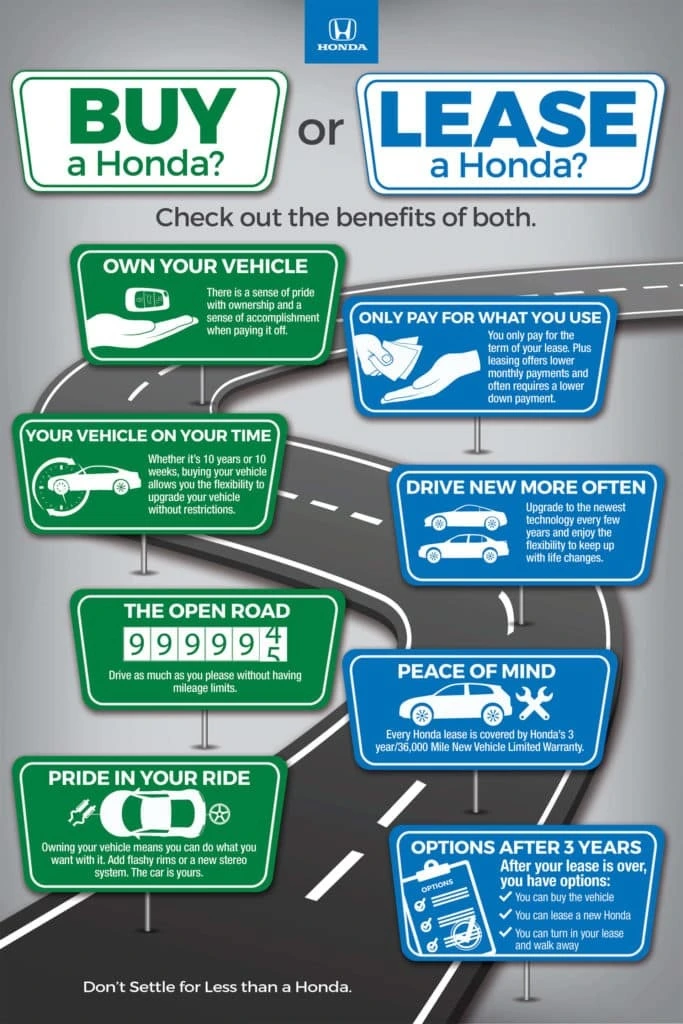

In the ever-evolving landscape of personal finance, one of the perennial debates revolves around the decision to lease or buy a new car. Both options come with their own set of advantages and considerations, making it crucial for individuals to weigh their financial circumstances and preferences before making a choice. In this article, we'll delve into the nuances of leasing and buying a new car to help you determine which option aligns best with your needs.

Understanding Leasing:

Leasing a car essentially involves renting it for a specific period, typically two to three years, during which you make monthly payments. At the end of the lease term, you return the vehicle to the dealership unless you choose to buy it outright. Here are some key points to consider about leasing:

-

Lower Monthly Payments: Lease payments are often lower than loan payments for a comparable vehicle since you're essentially paying for the depreciation of the car's value during the lease term, rather than the entire cost of the vehicle.

-

Minimal Down Payment: Lease agreements usually require a lower down payment compared to purchasing a car, making it a more attractive option for individuals who prefer to preserve their cash flow.

-

Warranty Coverage: Since lease terms typically align with the manufacturer's warranty period, lessees are often covered for most repair and maintenance costs, providing peace of mind against unexpected expenses.

-

Regular Vehicle Upgrades: Leasing allows you to drive a new car every few years, giving you access to the latest models and technological advancements without the hassle of selling or trading in your vehicle.

However, there are some drawbacks to leasing that you should consider:

-

Mileage Restrictions: Most lease agreements come with mileage limits, and exceeding these limits can result in costly overage fees. If you have a long commute or enjoy road trips, leasing might not be the best option for you.

-

No Ownership Equity: Unlike buying a car, leasing does not offer any ownership equity. At the end of the lease term, you return the vehicle without any residual value or equity buildup.

-

Potential Penalties: Lease agreements often stipulate penalties for excessive wear and tear on the vehicle or early termination of the lease, adding potential costs if you don't adhere to the terms.

Exploring Buying:

Buying a car involves taking out a loan to finance the purchase or paying for the vehicle outright. Once you complete the payments, you own the car outright and can keep it for as long as you desire. Here are some considerations for buying a new car:

-

Ownership Equity: When you buy a car, you're building equity with each payment. Eventually, you'll own the vehicle outright, and you can sell or trade it in for a new one, potentially recouping some of your initial investment.

-

No Mileage Restrictions: Unlike leasing, buying a car allows you to drive as much as you want without worrying about mileage restrictions or overage fees.

-

Customization: As the owner of the vehicle, you have the freedom to customize it to your liking without worrying about violating lease agreements or incurring additional charges.

-

Total Cost Savings: While monthly loan payments may be higher than lease payments, buying a car can be more cost-effective in the long run since you're not continually paying for depreciation.

However, there are some drawbacks to buying a car as well:

-

Higher Monthly Payments: Loan payments for buying a car are typically higher than lease payments since you're financing the entire cost of the vehicle, rather than just its depreciation.

-

Maintenance Costs: As the owner of the vehicle, you're responsible for all maintenance and repair costs once the warranty expires, which can add up over time.

-

Depreciation: Cars depreciate in value over time, and owning a car means you bear the full brunt of this depreciation, potentially resulting in a loss of resale value.

Which Option is Right for You?

Ultimately, the decision to lease or buy a new car depends on your individual preferences, financial situation, and driving habits. If you prioritize lower monthly payments, enjoy driving the latest models, and prefer minimal long-term commitment, leasing might be the right choice for you. On the other hand, if you prefer ownership equity, freedom from mileage restrictions, and the ability to customize your vehicle, buying a car could be the better option.

Before making a decision, it's essential to carefully evaluate your budget, lifestyle, and long-term goals to determine which financial option aligns best with your needs. Whether you choose to lease or buy, conducting thorough research, and consulting with a financial advisor can help you make an informed decision that suits your individual circumstances. I am here to help you every step of the way!

Dalton Stidham

(901) 504-8503

Homer Skelton CDJR